By automating the selling of investments that have underperformed, Wells Fargo helps investors claim up to $3,000 in tax-loss harvesting opportunities. In addition to offering a range of investment tools, Wells Fargo has also enhanced its online banking platforms with tax-loss harvesting capabilities. If you’d rather stay in control of your finances, Wells Fargo mobile banking is the way to go. In addition, you can view and transfer funds between accounts, as well as pay bills. And when you need to pay a bill, the app is convenient to use and lets you do all of your banking on the go. You can check account balances, make payments, and deposit checks. The Wells Fargo Mobile app has a simple user interface that makes it easy to manage your money. Wells Fargo mobile banking is one of the easiest ways to manage your finances. However, if you use a commercial account, you should be able to opt-in for this feature.

However, this feature is not available to all customers. It also has plans to roll out an eye-scanning for mobile sign-in by July 2016.

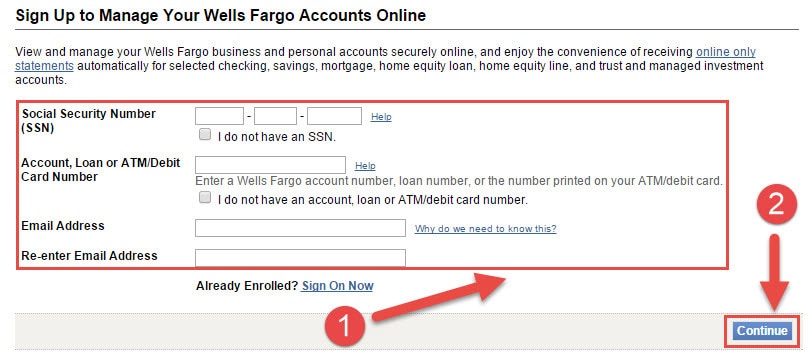

#Wells fargo online banking home page verification#

If you’d like to add more features, you can enroll in the 2-step verification feature.įor now, Wells Fargo offers a mobile banking app that comes with instructional videos and a security guarantee. Then, log in to your account using your username and password. You can access Wells Fargo mobile banking by texting the word “mobile” to 93557. All you need to do is enroll in the service and receive a text message with your account details. With Wells Fargo Mobile Banking, you can access your account details from anywhere, including your smartphone. Once you’ve completed your registration, you can start utilizing Wells Fargo’s services to Manage your Accounts. This article will go over mobile banking, overdraft protection, and the Platinum and Analyzed accounts. You can find a wide range of online banking services at Wells Fargo, including the mobile app.

If you’re looking for a new bank, you’ve come to the right place.

0 kommentar(er)

0 kommentar(er)